Governor Shapiro’s Bold Tax Plan

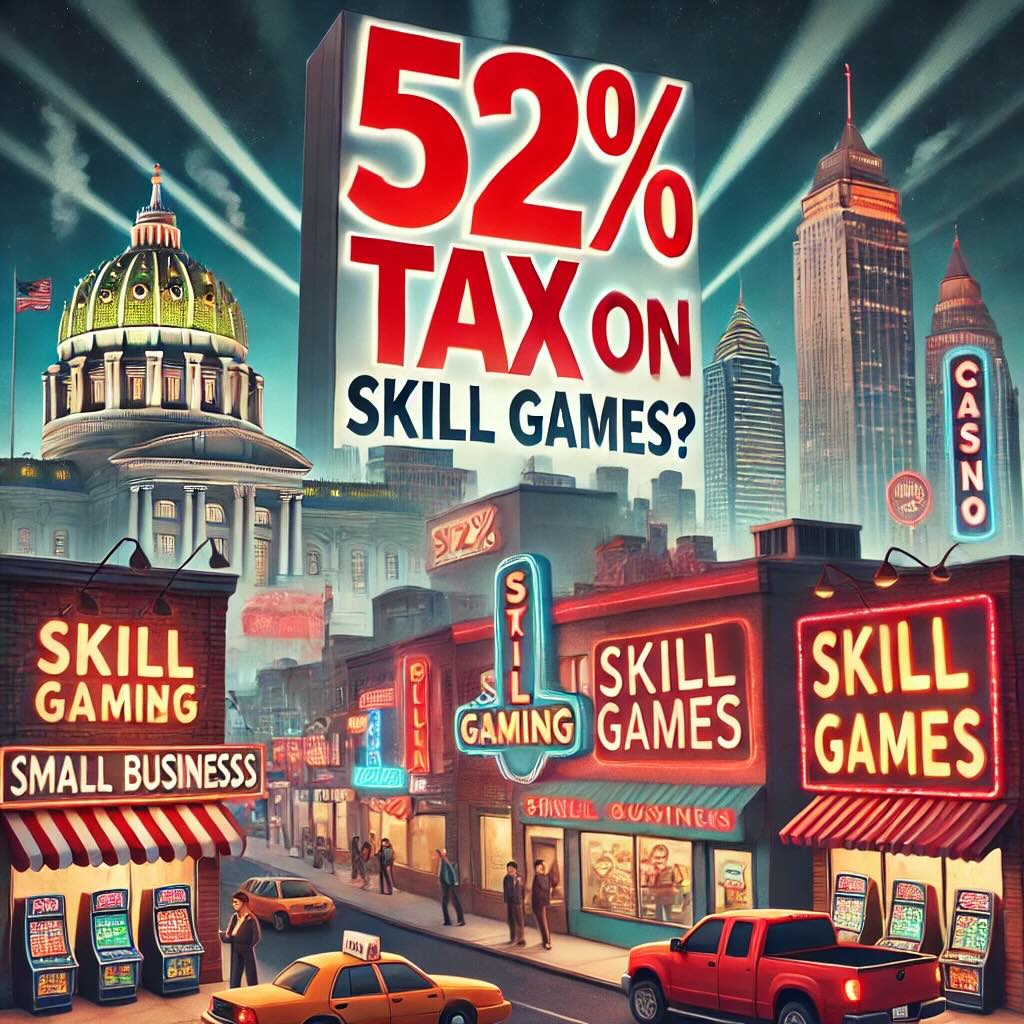

Pennsylvania Governor Josh Shapiro has proposed a 52% tax on skill-based gaming machines, aiming to generate $360 million in annual revenue. This plan, however, has been met with fierce resistance from lawmakers and industry stakeholders.

State Senator Gene Yaw, a vocal critic of the proposal, plans to introduce alternative legislation advocating for a significantly lower 16% tax rate. He argues that skill-based gaming supports small businesses and should not be taxed at the same rate as casino slot machines.

Oversight and Regulatory Concerns

Another contentious aspect of Shapiro’s proposal is granting the Pennsylvania Gaming Control Board (PGCB) sole authority to determine which establishments can host skill-based gaming machines. Yaw opposes this move, advocating for the Department of Revenue to oversee operations instead, citing concerns over PGCB’s close ties with casinos.

The Future of Skill-Based Gaming in Pennsylvania

With Pennsylvania’s gaming revenue surpassing $6.1 billion in 2024, skill-based gaming remains a lucrative but controversial sector. The legislative battle ahead will determine the industry’s trajectory, balancing revenue generation with the interests of local businesses and regulatory bodies.

Personal Insight

Taxing skill-based gaming at such a high rate risks stifling an emerging industry that benefits small businesses. While regulation is necessary to ensure fairness and oversight, an overly aggressive tax strategy could push operators out of the market, limiting consumer choice and economic growth in the sector.