Introduction:

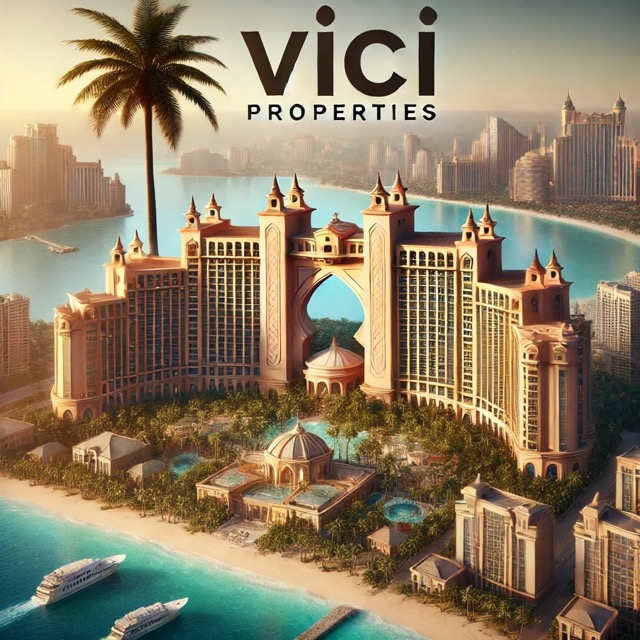

Real estate investment giant VICI Properties is reportedly exploring an acquisition of the renowned Atlantis Resort on Paradise Island, marking a significant shift in its portfolio toward global destinations. This acquisition could set a precedent in gaming real estate investments, blending VICI’s existing model with the unique demands of a resort like Atlantis.

Strategic Investment in Paradise Island

VICI’s potential acquisition of Atlantis underscores its strategy of targeting high-value hospitality and gaming properties. With VICI already managing iconic properties like Caesars Palace and MGM Grand, expanding into Paradise Island offers a logical step in establishing a diversified international presence. This move not only represents substantial investment but also signals confidence in the resort’s potential for growth and profitability.

A Unique Approach to Real Estate in Gaming

If the deal proceeds, VICI’s ownership would focus on the physical real estate, allowing Brookfield to retain operational control. This approach aligns with VICI’s asset-light, high-revenue model, prioritizing long-term leasing and property appreciation without assuming day-to-day management risks. Atlantis offers a lucrative opportunity, aligning well with VICI’s portfolio of upscale gaming resorts and hospitality assets.

Potential Long-Term Impact for VICI

Securing Atlantis could strengthen VICI’s position as a leader in high-value gaming properties. This potential acquisition illustrates a broader trend in gaming real estate, where strategic partnerships redefine operational models and unlock diverse revenue streams. As VICI continues its growth trajectory, the Atlantis acquisition may well enhance its global influence and drive sustainable returns.

Free Gambling Industry Research

M&A in Gaming