Dear Reader,

This article was originally published in the SCCG Management Weekly Newsletter #2 on August 20, 2020.

You can receive early access to articles like this, and other content by signing up for the weekly newsletter by clicking the button below.

Thanks for being part of the SCCG community!

For months, dedicated sports fans faced tremendous uncertainty as live games were cancelled or delayed in the face of the COVID-19 lockdowns. For many of us, the pleasure of fandom, not the least of which includes a significant amount of escapism, was out of reach when we seemingly needed it most.

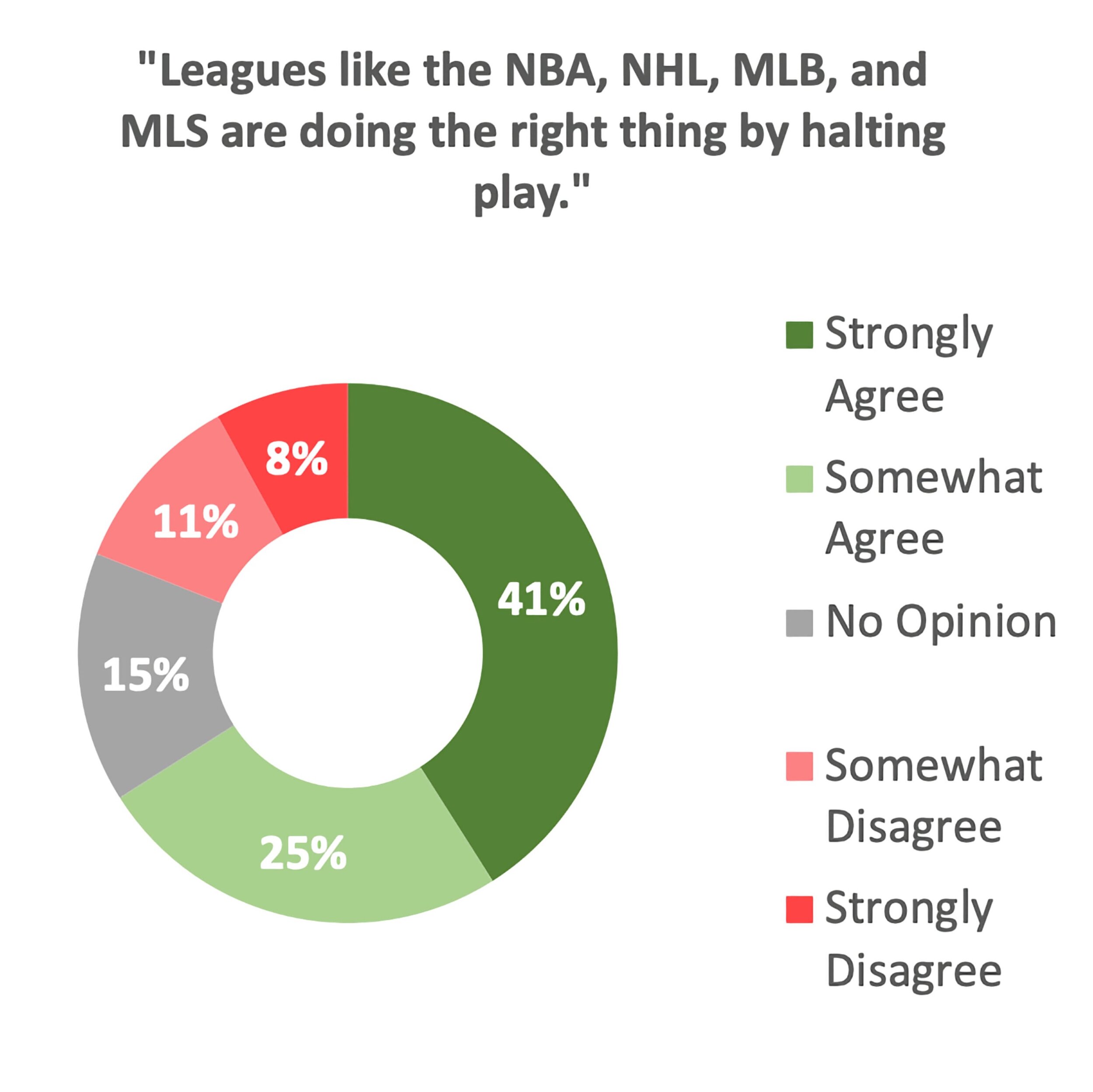

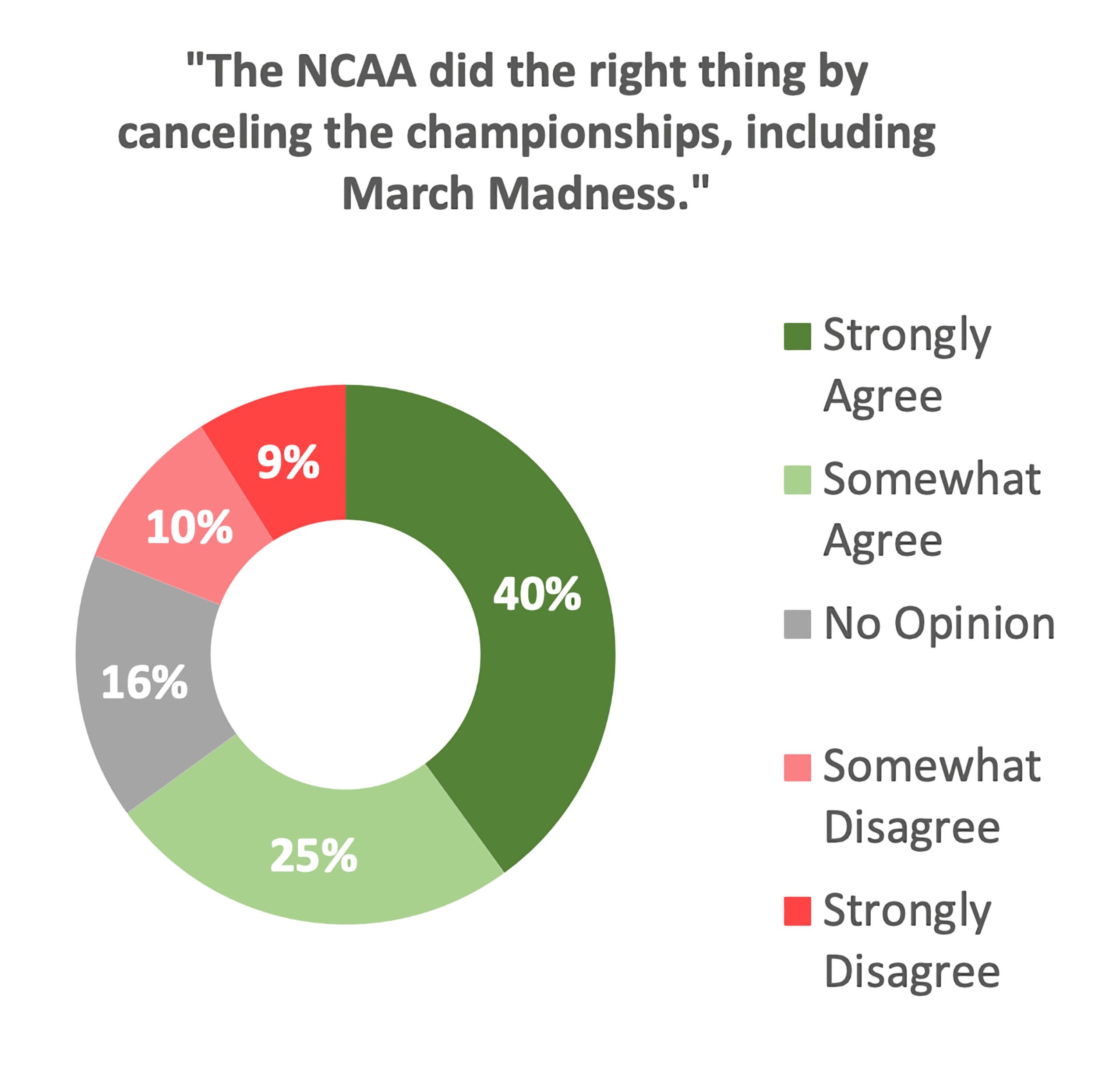

These perceived factors made the results of a Morning Consult survey announced on March 13, 2020, all the more surprising that, “2 in 3 U.S. adults agree with the sports league’s decisions to halt play”.

The Morning Consult online national tracking poll was conducted between March 12-13, 2020 among a national sample of 2,201 adults, and their results were published as having a margin of error of plus or minus 2 percentage points.

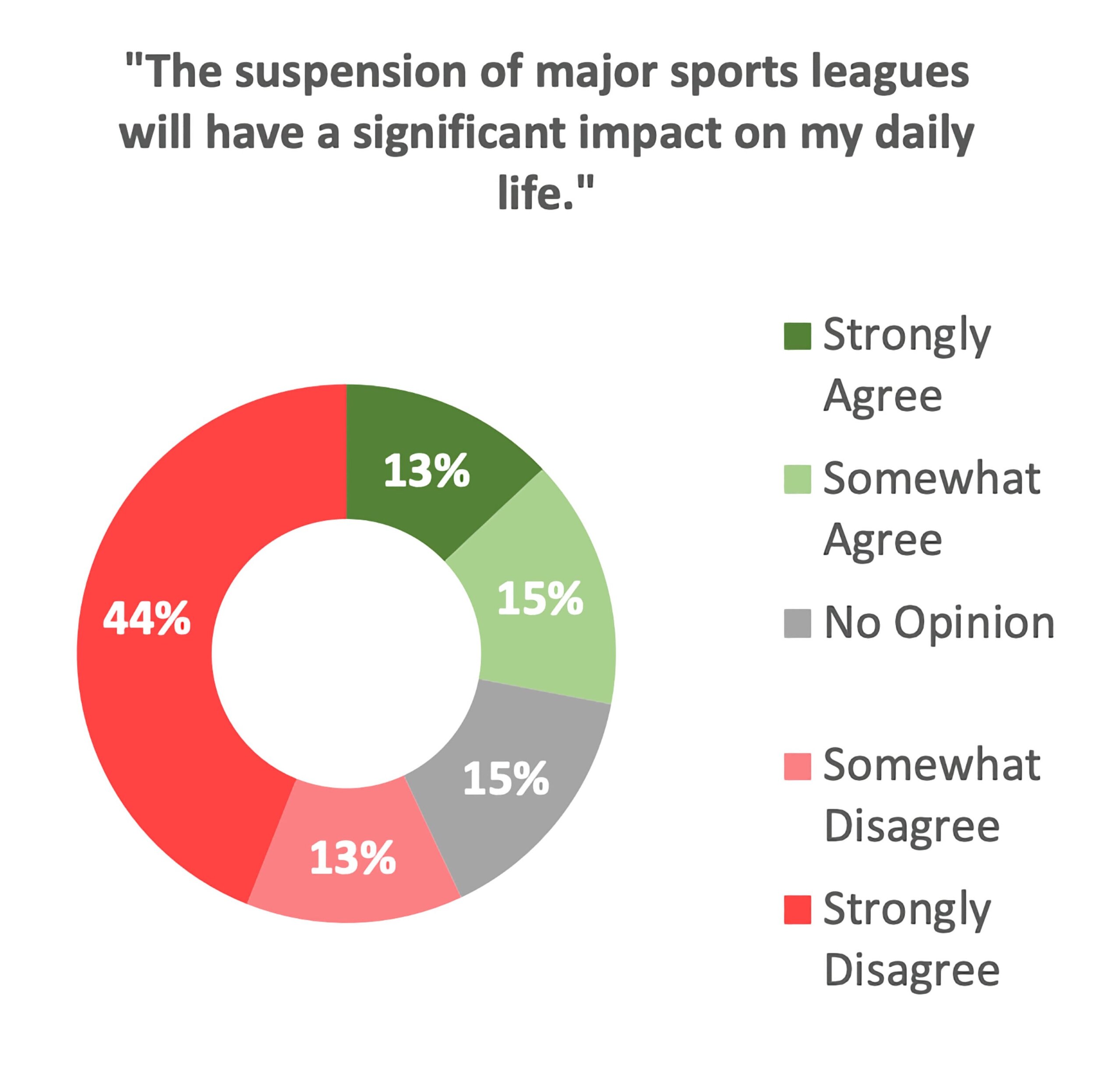

Further, only a little over a quarter of U.S. adults indicated that the suspension of pro sports would have a significant impact on their daily lives. Clearly, in an environment where lockdown conditions between March and today, dramatically changed our day to day routines, most U.S. professional sports fans did not perceive a significant impact.

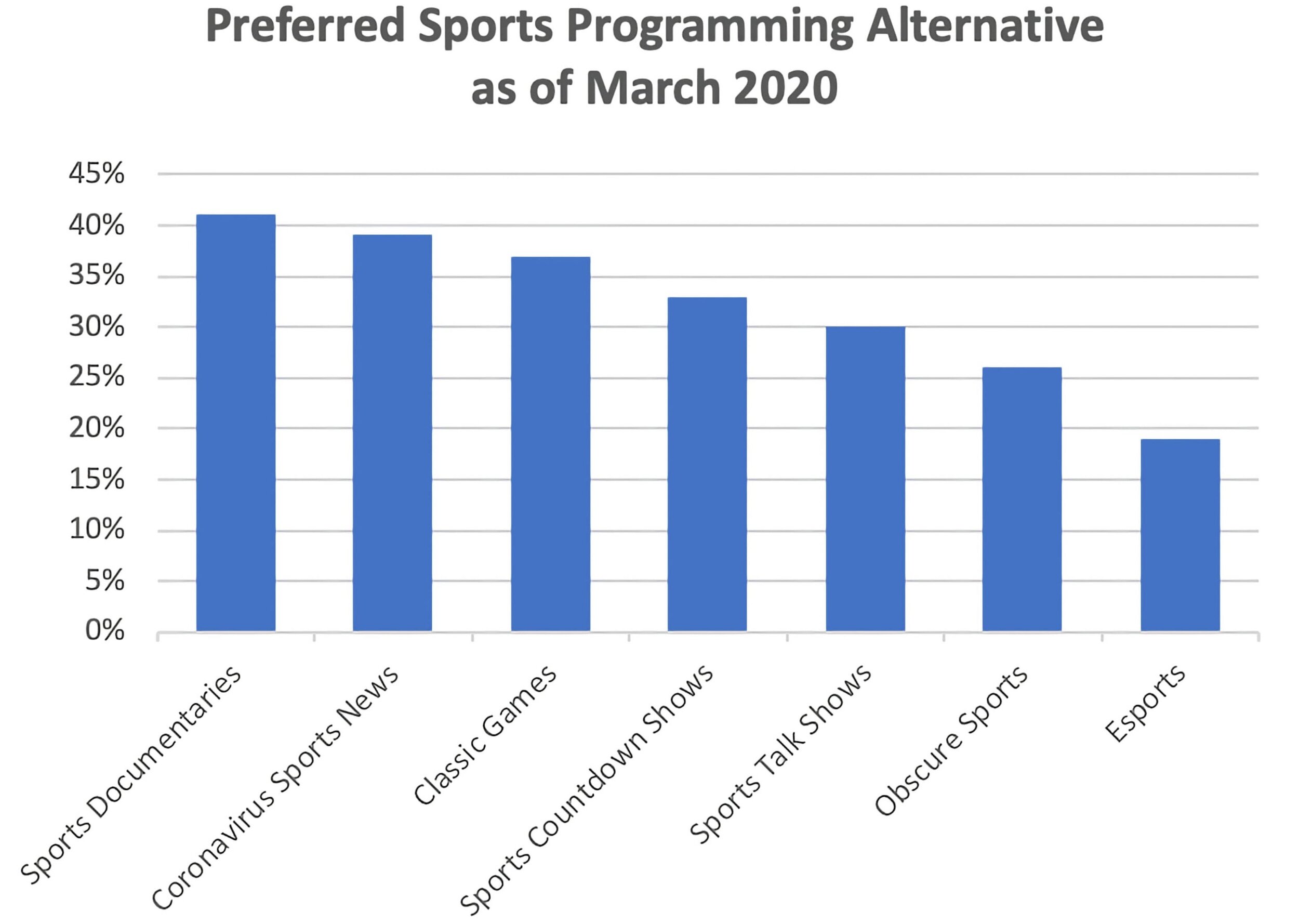

Accepting the reality of the situation, according to a subsequent Morning Consult survey conducted March 20-22, 2020, these fans were comfortable with turning to alternatives to traditional live sports entertainment.

Sports fans turned to sports documentaries, sports news related to COVID-19, and classic games lead the interest categories (41%-37%), with sports entertainment meta-content like countdown shows and talk shows close behind (30%-26%). The last block of categories of interest to “sports starved fans” were obscure sports (at least, to the US market), and esports.

“PURE” ESPORTS

Given the unique nature of esports among other professional sports, there was a lot of online only tournament content during this period. Overwatch League (OWL) which began in February, 2020, ran through this period online, with a scheduled ending August 8-10 for Overwatch League Week 27 in Toronto, Canada, and Los Angeles, USA. Other popular esports title tournaments included Call of Duty League, whose remaining 2020 events will be conducted online only.

WHERE TRADITIONAL SPORTS AND ESPORTS MEET

According to Autoweek, March 31, 2020, the March 22nd race at Homestead-Miami on FS1 had set a esports TV ratings record, watched by over 900,000 viewers.

In addition to the major “pure” esports titles, events intersecting traditional sports and esports have received significant attention. When the NASCAR 2020 seasons were suspended due to COVID-19, NASCAR organized the eNASCAR iRacing Pro Invitational event beginning March 22nd at a virtual Homestead-Miami Speedway and ending at a virtual North Wilkesboro Speedway on May 9. Originally conceived as a one-time event, the event’s popularity drove it to become a weekly series on Fox Sports, for drivers in all NASCAR series.

NEW OPPORTUNITIES

- Extending Successes: Nielsen Sports reported that over 1.3 million viewers watched the O’Reilly Auto Parts 125, through Fox and FS1.

- Brand Reactivation: Fox Sports reports that the Texas eNASCAR iRacing Pro Race broadcast attracted 255,000 viewers who hadn’t watched a NASCAR Cup Series race in 2020.

- Strong Share across Competing Mass Media: The Texas Motor Speedway Race viewership was second only to WWE’s Friday Night Smackdown on Fox, with an average 2.374 million viewers.

RESILIENT SPORTS FANS

As the NBA, NHL and MLB relaunched games through July and August, we see that fans remained loyal and resilient to the changes associated with the leagues efforts to launch under differing circumstances.

- The NBA: SportsMediaWatch, ShowBuzzDaily reporting and analyzing Nielsen ratings year over year for Monday, July 7 through Sunday, August 2, indicate that “After a strong return Thursday, NBA ratings over the weekend were pretty ordinary”, showing that there was not a significant falloff in viewership year over year, even with SportsMediaWatch also reporting that “the level of households using televisions (HUT) is seven percent lower in July than in March and April, when the season was originally scheduled to conclude.”

- The NHL: SportsProMedia analysis of Nielsen Total Audience Delivery (TAD) statistics reported that, “Ice hockey league’s return gives NBC most-watched double-header in four years”, and that the two matchups on the main NBC channel averaged a TAD of 1.117, up four percent from last year.

- MLB: Forbes news reported that, “Based on numbers from Nielsen by way of Home Team Sports—a division of FOX Sports that represents every regional sports network in the country for ad sales, brand partnerships, marketing and more—the 29 U.S.-based MLB teams and their regional sports networks through July 30 saw an overall increase of 17% year-over-year in total ratings (3.66 vs. 3.11).” This early burst of enthusiasm settled down in the end of July with SportsMediaWatch reporting that Fox, ESPN and TBS ratings were back down to average rating levels.

THE WRAPUP

It’s clear that pro sports audiences are resilient and will follow and be loyal to quality content that aligns with brands, leagues, teams and their pro players in significant numbers. We think there’s a significant opportunity for sports marketing professionals who can find partners to leverage high value opportunities in these emergent events and spawn entire new categories of sports entertainment.

Can we look at existing and future partnership agreements and, with creativity, carve out a path to exploring and unlocking opportunity value created by the current state of professional sports in a COVID-19 world?

Yes. We think so too.