Distributed Gaming: The New Frontier in Gambling

The gambling industry is evolving at an unprecedented pace, and nowhere is that more evident than in the rise of distributed gaming. This umbrella term encompasses skill-based machines, pull tabs, charitable gaming, historical horse racing (HHR), sweepstakes, social gaming, and arcade-style gaming—formats that are rapidly expanding outside traditional casino environments. Having spent decades advising, investing in, and shaping the gaming industry, I’ve seen firsthand how these emerging segments are blurring the lines with regulated gambling. As the industry adapts, the biggest opportunities will come from embracing innovation while working within the right regulatory frameworks to ensure long-term sustainability.

Skill-Based Gaming Machines: From Casinos to Convenience Stores

Not long ago, casinos experimented with skill-based slot machines—arcade-like games designed to engage younger audiences. I supported these efforts, but the reality is that skill-based slots in casinos remain a niche. However, the much bigger development has been the explosion of unregulated skill machines across gas stations, bars, and mini-marts nationwide. Often disguised as entertainment devices, these machines walk a fine legal line by incorporating minor skill elements while still functioning as de facto slot games.

The numbers are staggering: Americans now wager an estimated $100 billion annually on these unlicensed machines, depriving states of billions in tax revenue and pulling money away from regulated operators. The patchwork of state laws means some jurisdictions treat them as illegal gambling while others lack clear regulations, creating a wild west scenario. In the past year, Pennsylvania, Kentucky, Virginia, Missouri, and Texas have all wrestled with whether to ban or regulate these machines.

In my view, outright prohibition isn’t the answer. We’ve seen time and time again that a regulated, taxed, and monitored market is better than a black-market free-for-all. Georgia offers a strong model—by classifying skill-based machines as Coin Operated Amusement Machines (COAM) under the state lottery, the state has built a structured industry that generated $1.4 billion in revenue in 2023, with $140 million benefiting education. This is the direction other states should follow—creating a structured distributed gaming market that ensures fairness, consumer protections, and tax revenue.

Pull Tabs and Charitable Gaming: Old Formats, New Tech

Charitable gaming has always played a significant role in community fundraising, with bingo halls, raffles, and pull tabs being mainstays for veterans’ groups, nonprofits, and fraternal organizations. But the game is changing. Electronic pull-tab machines (“e-tabs”) have digitized the classic paper format into sleek, slot-style tablet games, driving explosive growth.

Take North Dakota, where e-tabs generated $1.9 billion in gross gaming revenue in 2023, delivering over $205 million to charitable causes. Or Minnesota, where e-tabs have become a $6.3 million-a-day business, with projections showing $2.3 billion in sales for 2023, completely eclipsing paper pull tabs.

While this technology has modernized charitable gaming, it’s also raised important regulatory questions. Some states have imposed new rules to ensure e-tabs don’t operate too similarly to casino slots, while others are questioning whether nonprofits are now running de facto gambling businesses. The key is maintaining a balance—these games must continue benefiting communities while ensuring fairness and transparency. If done right, regulated charitable gaming can thrive without encroaching on the casino industry’s turf.

Historical Horse Racing: Betting on the Past to Fuel the Future

Few areas of distributed gaming have seen faster growth than historical horse racing (HHR). These machines, which allow players to wager on previously run horse races, have become a major revenue driver in states where traditional casino expansion isn’t politically viable.

Kentucky stands out as a model for HHR’s success—in 2023, HHR parlors in the state handled an astonishing $5.2 billion in wagers, up $1 billion from the previous year. That money has revitalized the horse racing industry, funding record purses and attracting top-tier talent to Kentucky tracks.

HHR’s growth extends beyond Kentucky. States like Wyoming, Virginia, and New Hampshire have embraced HHR, leveraging it to boost their horse racing economies. The regulatory model is key—HHR thrives because it’s structured within the pari-mutuel wagering system, differentiating it legally from slot machines. With the right oversight, HHR presents a massive opportunity for racing states looking to modernize their industry without resorting to full-scale casinos.

On the Floor at Amusement Expo International 2025

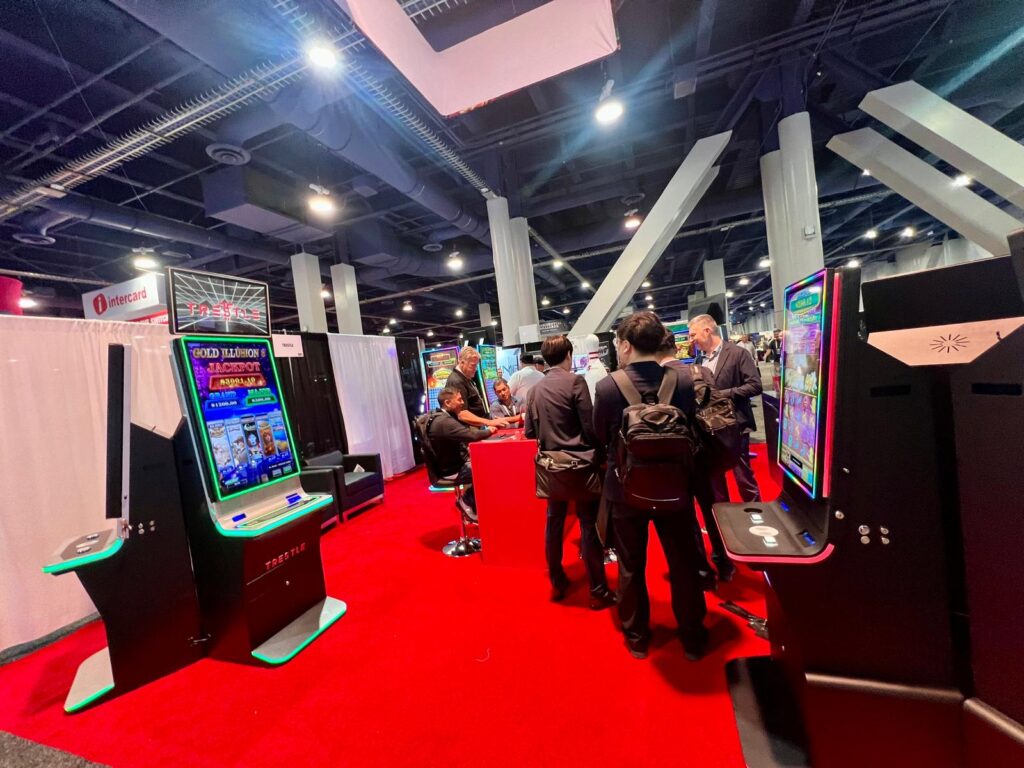

To truly understand the intersection of amusements and gambling, you have to experience Amusement Expo International, held annually at the Las Vegas Convention Center. Walking the floor this year, it was impossible not to notice the convergence of skill, arcade, and distributed gaming. The latest innovations in VR, arcade, and redemption games show that the demand for interactive experiences is driving the future of gambling.

Casino operators and distributed gaming companies are taking notes. The most forward-thinking brands are studying amusement game models—how they engage players, reward skill, and drive repeat play—to inspire the next generation of casino and distributed gaming products. The trend is clear: gambling and amusement gaming are merging in new ways, opening fresh opportunities for the industry.

Conclusion: A Fast-Evolving Space and the Road Ahead

Distributed gaming is no longer a niche—it’s a core component of the modern gambling landscape. From skill-based machines in convenience stores to pull tabs in fraternal clubs and historical horse racing parlors revitalizing tracks, these formats are here to stay. The key is regulation—operators and lawmakers need to work together to create structured, fair, and responsible distributed gaming markets that provide entertainment while contributing to tax revenues and community support.

At SCCG, we’re committed to helping the industry navigate this fast-moving space. That’s why our latest research report, “A Primer on Distributed Gaming”, will provide a deep dive into the current landscape, emerging opportunities, and best practices for responsible expansion. Whether you’re an operator, investor, or regulator, staying ahead in distributed gaming means understanding its complexities—and we’re here to help.

References

- Spectrum Gaming Group – Top 10 Gaming Trends for 2025 (U.S.)

- American Gaming Association – Report on Illegal and Unregulated Gaming

- Covers.com – “Unregulated Skill Machine Battleground” (July 18, 2024)

- Georgia Lottery Corp. – COAM (Coin Operated Amusement Machine) Revenue Data, 2023

- Vixio Gaming Compliance – Charitable Gaming Changes in ND & MN

- MPR News – Minnesota Electronic Pull-Tabs Report

- TrueNicks/BloodHorse – HHR Growth in Kentucky (Apr 2023)

- Business Research Co. – Social Casino Market Outlook 2025

- Arcade Heroes – Amusement Expo 2025 Preview

- Stephen Crystal (LinkedIn Post) – Skill-Based Slots – A Work in Progress