The Evolution of Event-Based Contracts in Sports Betting

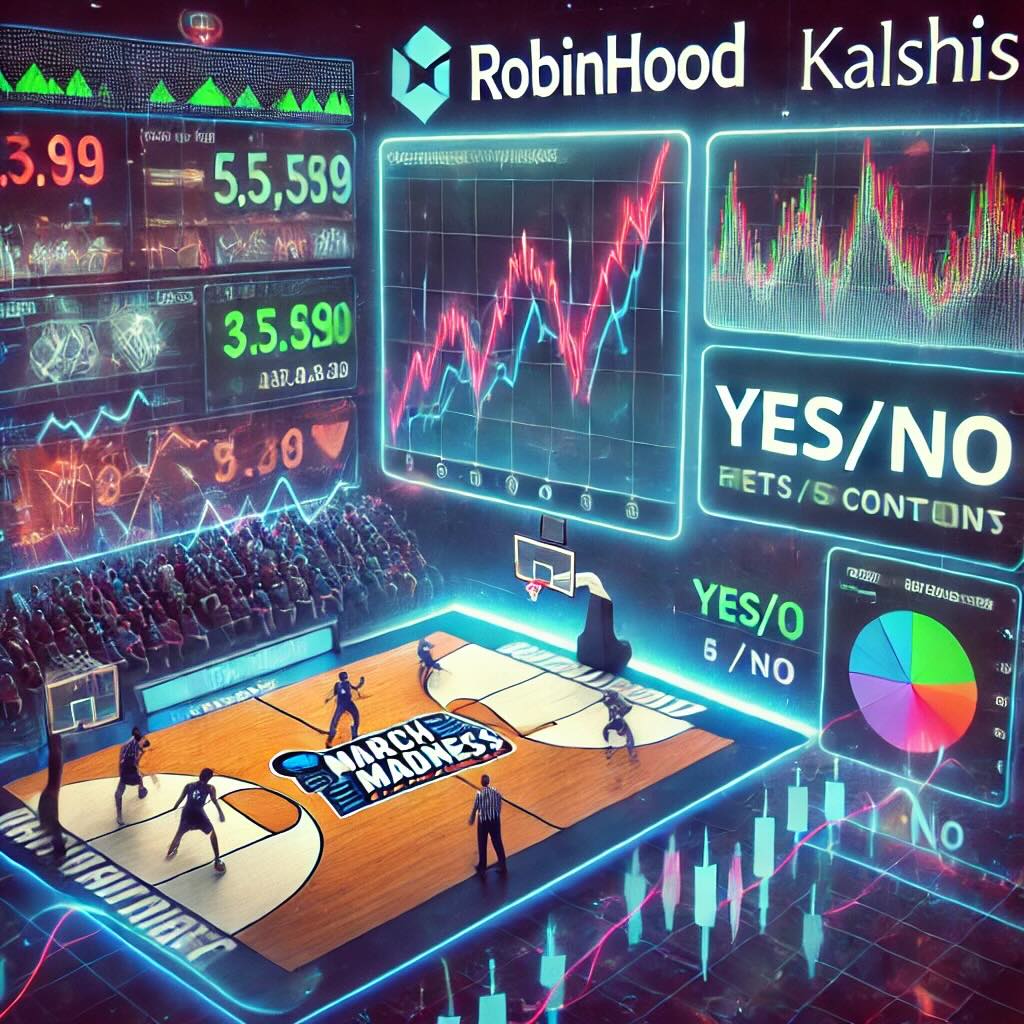

Robinhood has made a bold move by partnering with Kalshi to offer event-based contracts for March Madness, marking a significant shift in the online betting landscape. This innovative approach blends traditional sports wagering with financial market principles, allowing users to trade contracts based on game outcomes.

The partnership follows a failed attempt to launch Super Bowl event contracts, which faced regulatory scrutiny from the Commodities Futures Trading Commission (CFTC). This time, Robinhood has built its own prediction market hub, ensuring better compliance and control over the offering. The NCAA tournament, known for its unpredictable upsets, provides an ideal testing ground for these contracts, where users can place “yes” or “no” bets on team victories.

The Future of Sports Prediction Markets

With a $3.1 billion betting market expected for this year’s NCAA tournament, Robinhood’s move signals a potential shift in how investors and bettors engage with sports events. The ability to trade event contracts like stocks could attract a broader audience beyond traditional sports bettors. However, regulatory challenges remain, as authorities continue to scrutinize event-based betting models. If successful, this initiative could pave the way for a new era of sports betting, blending investment strategies with traditional wagers.

Personal Insight

Robinhood’s venture into prediction markets is a fascinating development that could reshape the intersection of finance and sports betting. If handled correctly, this model could create a more strategic approach to wagering, allowing casual bettors and financial traders to engage in an innovative way. However, the regulatory landscape will ultimately decide whether this experiment flourishes or gets cut short.