Volume 45 | June 17, 2021

WEEKLY EDITION

June 17, 2021

Gaming America Article: Sports Data 101

Stephen Crystal, founder of SCCG Management, writes on driving data and opportunity in the US sports betting sector.

The availability of timely, high-quality sports data has never been more critical to gaming industry operators and consumers. Consider, though, the massive number of sporting events played every day around the world. It would be an unrealistically huge investment for even the most prominent sports media companies to cover and capture statistics from each of these events in real-time. This reality has created a new industry in real-time sports data firms, which can scale the collection of game events and sell access to that data to multiple consumers.

OFFICIAL LEAGUE DATA

Not all data is considered equal. In the sports betting industry expansion across the US, there has been a lot of discussion on the control over data and what data can be legitimately used by sports betting operators to consummate wagers. Leagues have used these arguments to create additional revenue streams for their organizations by monetizing their data. While the organizations themselves can’t participate directly in sports wagering revenue, integrity fees imposed upon the operators have been the league’s preferred methods to drive revenue.

Some jurisdictions have made distinctions beyond the binary, official vs. not, creating tiers. For example, in Illinois:

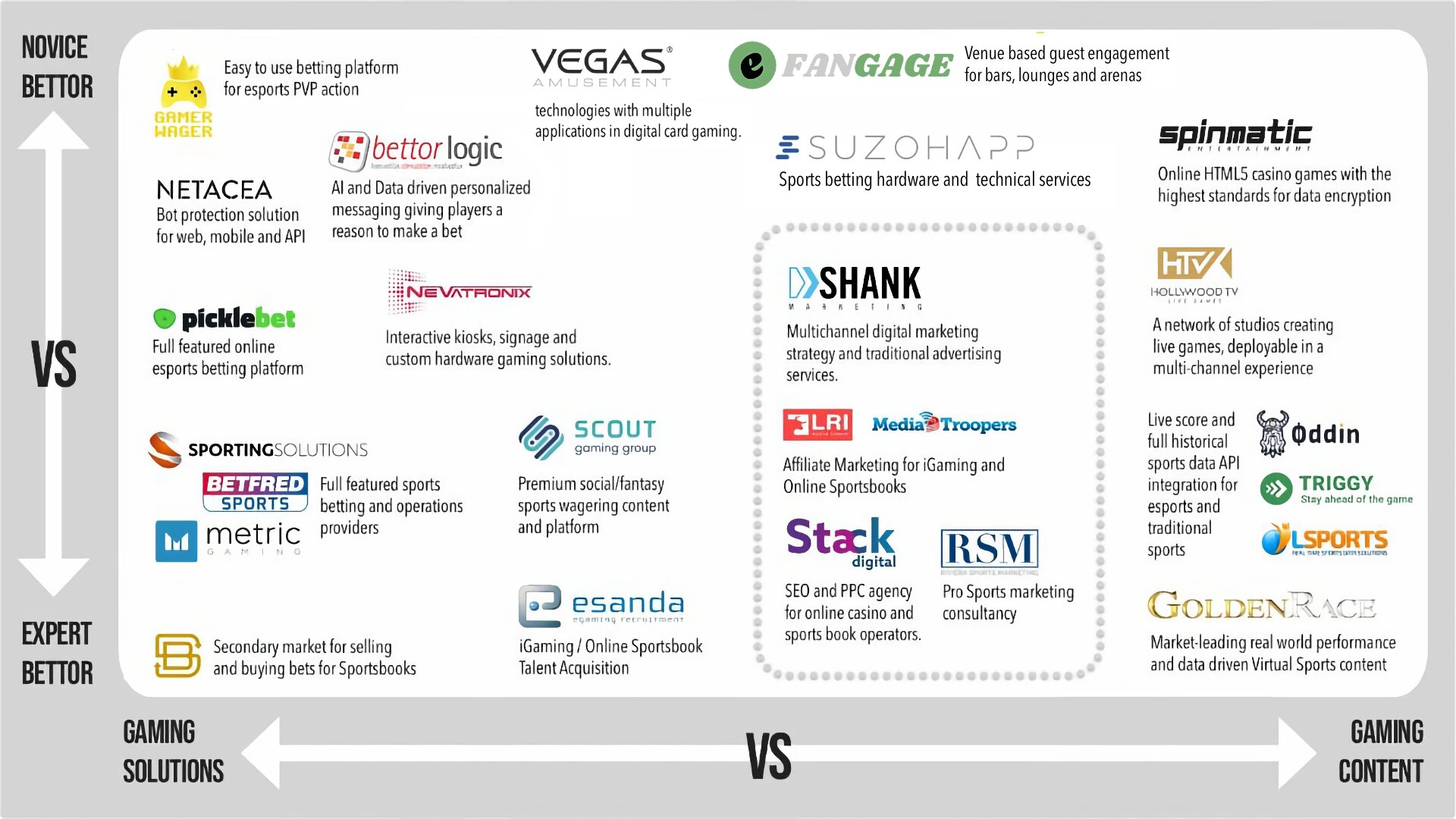

SCCG Client Partners

SCCG Contributing Writer

In 1989, South Dakota legalized gambling in the historic town of Deadwood, long known as a goldrush town during the 1800s. Today, South Dakota lawmakers are one step closer to bringing legalized sports betting to their home state, although the current legislation is quite restrictive for residents of the midwestern state. South Dakota will almost certainly take bets at some point in 2021, but will the existing legislative structure allow the state to benefit from the current legal sports betting landscape?

Earlier this week, The Legislative Rules Review Committee approved the South Dakota Gaming Commissions’ proposal for sports betting in the state. Voters chose to legalize sports betting in November of 2020, but only in a limited capacity. The legislation passed will limit bettors to brick-and-mortar retail locations in the gambling town of Deadwood, which lies roughly 40 minutes east of the Wyoming border. The limit means that users located in the state will not be able to wager online, significantly restricting potential revenue from sports betting. As it stands, people wanting to bet must register in-person at a casino in Deadwood, including the 11 tribal casinos in the state, all of which are located in town.

The way I see it, South Dakota is making strides towards an optimal set of regulations, but they are still missing out on a ton of potential revenue when it comes to sports betting. It takes over 6 hours in the car to drive from Sioux Falls, South Dakota’s most populous city, to Deadwood. The large majority of the state will have to travel a long way if they wish to make bets in their state legally. For Sioux Falls residents, it makes much more sense for them to drive 5-10 minutes to cross over into the Iowa border, which has statewide mobile registration and wagering. South Dakota also has other neighboring states that have passed or are passing legalized sports betting legislation, including Wyoming, Montana, and Nebraska.

If I were in charge of drafting sports betting legislation for the state of South Dakota, I would try my hardest to mirror the structure that the state of Iowa has adopted. Allowing for statewide mobile registration and wagering is the only way to bring full betting access to the residents of your state, and in turn, herald more tax revenue for the state. If I saw residents of my state crossing borders make legal wagers, I would do everything in my power to make sure my constituents are spending their money within my state’s jurisdiction. The retail sports betting experience in Deadwood will be a pleasurable one. But for many, more the logistics created by this legislation will drive tax dollars over the border. So why is it being done? People who want to place legal sports wagers will do so in a neighboring state. Those that do not care about the legality of their bets will continue to use unlicensed channels. In both cases, South Dakotans lose the benefit of their taxable spending to neighbors and unlicensed operators. We suspect the people of South Dakota will continue to ask why things are the way they are rather than how they could be.

WELCOME TO YOUR ROUNDUP OF EUROPEAN IGAMING NEWS

Our weekly US-UK focused iGaming feature article summarizes the thoughts of Jake Pollard, an experienced journalist and editor who has covered the online gaming and betting industry for many years. He has written for the leading media outlets as well as operators and suppliers in the igaming space. His areas of focus are wide-ranging and include regulatory developments in the US, emerging markets in South America and how European countries are adapting to a decade of igaming regulation.

Hindenburg – going down like a lead balloon?

The Hindenburg report into SBTech’s alleged activities in black market jurisdictions in Asia and the middle east dominates this week’s news. Hindenburg is an aggressive short seller and the aim of the report was to drive down DraftKings’ share price. Publication partly achieved its aim, although not by as big a margin as Hindenburg would have hoped. DraftKings’ shares were down 10% when trading opened and finished the day down 4%. What was most notable about the claims in the report was that they were (finally) made public. Indeed, the rumours and stories about alleged SBTech activities in those markets have been circulating for years. Interestingly, all analyst reactions were pretty calm. They acknowledged the reputational damage such claims could have on the industry but expected the current positive market sentiment to remain. Should there be negative regulatory consequences in the long term, such as DraftKings not being awarded a license or having issues within a regulated state because of the claims in the report, then things could change. But that is not on the cards currently. The fact that SBTech represents just 10% or less of DraftKings revenues and that the group has made clear its intention to focus on consumer-facing operations are further reasons why the impact of the report has not been as strong as might have been expected; even if the highly detailed information contained within it made for a fascinating read.

Stool share slide

Bartsool Sportsbook’s market share in Michigan dropped for a fourth consecutive month in May to 7.7%, from its high of 23.9% when the state opened in late January. The dramatic drop shines a somewhat unflattering light on the group’s business model, which can be summed up as dropping CEO Dave Portnoy and his ‘Stool colleagues into a newly-regulated state and generating lots of social media noise around it. To be fair Portnoy and his crewmates are very successful at it, but the subsequent fall in its numbers is a direct result of the early enthusiasm petering out as the team moves on (or back to its new York offices).

No channel hopping

Channelisation, or driving the vast majority of players to licensed sites, is such an important issue for regulated markets and has so often been highlighted as one of their biggest regulatory failings that it is not surprising to see the Danish gambling regulator lead its Gaming Market in Figures report with the claim that the dot dk operators achieved channelisation rates of 90% in 2020.

SCCG Management: New and Upcoming Events

LSports Team in Las Vegas

The LSports leadership team will be in Las Vegas this month, from the 20th to the 24th of June, to catch up on current developments with their partnership with the AUDL, and AFFL, and the state of sports data feeds in the US. If you are interested in discussing these topics, please contact us directly.

LSports Becomes Official Data Partner of the AFFL

ASHKELON, ISRAEL, LAS VEGAS, and NEW YORK (June 16, 2021) – The American Flag Football League (AFFL), the preeminent flag football organization in the United States, and LSports, a global leader in the delivery of real-time sports data solutions, today announced an exclusive data distribution partnership valued at $6 million USD.

SCCG Management curates a feed of news articles from over one hundred of the best industry news sources.

Keep up to date on the items in the news that interest and excite us!